Rust Never Sleeps (May 2025)

“Hey hey, my my

Rock n’ roll can never die”

– Neil Young

“Last year, David Einhorn of Greenlight Capital pronounced that value was “dead”.

Another speaker at the London conference, Alissa Corcoran of Kopernik Global Investors refutes this claim.

Value investing is immortal, she says.”

– Edward Chancellor

Breakingviews column, May 16, 2025

Our colleague, Co-CIO Alissa Corcoran, recently spoke at the Value Invest – London conference and was quoted as saying “value investing is immortal.” Now the first thought that should pop into everybody’s mind is “of course it is, value investing simply means investing in assets that are selling for less than they are worth, a methodology that surely will never die.” However, the first thing that popped into my mind was the lyrics to Hey Hey, My My (Into the Black), from Neil Young’s groundbreaking Rust Never Sleeps album. By now, this odd characteristic of mine is familiar to most of you. And, while the durability of value should be self-evident, the timing of its comeback is a question that has been coming up with increasing frequency lately. This trend, plus the validity of Neil’s continuing lyrics from this song, “there’s more to the picture than meets the eye,” dictate that delving further into the picture of contemporary investing is a worthwhile endeavor.

“My my, hey hey

Rock and roll is here to stay”

If you ask someone if they prefer Neil Young or Crosby, Stills, & Nash (his former colleagues in the band CSN&Y), they are unlikely to express indifference. They usually have a strong preference one way or the other (apologies to the younger readers who undoubtedly have no clue who any of them are). I’m in the Young camp: Rockin’ in the Free World, Old Man (Look at My Life), Heart of Gold, Like a Hurricane, After the Gold Rush, Cowgirl in the Sand, Southern Man, Ohio (yes – with CSN) and many others, including, of course, My My Hey Hey.

As an aside, Lynyrd Skynyrd’s biggest hit – Sweet Home Alabama – was a rebuke of the song Southern Man, although Neil was friends with Skynyrd leader Ronnie Van Zant. In fact, in his 2012 autobiography, Waging Heavy Peace, Young writes: “My own song Alabama richly deserved the shot Lynyrd Skynyrd gave me with their great record.” He is said to have written Powderfinger for them, but they hadn’t had a chance to record it before the tragic plane crash. (He ended up recording it himself.) For those who object to his political views, it’s my policy not to focus on them when it comes to any and all musicians, actors, and sports stars. It’s not relevant to their areas of expertise.

“Out of the blue”

I have a three-decade history of finding a value-investing message in the lyrics of songs. This song’s message is, to me, a metaphor for “anti-value” i.e. momentum investing. Why use that? Because it captures the zeitgeist of the current times, brings up issues about how things became this crazy, and, of course, lays the foundation for the premise that value investing will return to prominence sooner rather than later. As the song says – “The King” is gone but he’s not forgotten.

“It’s better to burn out

Than to fade away”

Per Songfacts – “This deals with the fleeting nature of fame and how hard it is to stay relevant as an artist. Going ‘out of the blue and into the black’ is when the popularity wanes and the singer fades from memory.”

Per Spin magazine, Young stated, “Rust implies you’re not using anything, that you’re sitting there and letting the elements eat you. Burning up means you’re cruising through the elements so f#$%ing fast that you’re actually burning, and your circuits, instead of corroding, are f#$%ing disintegrating. You’re going so fast you’re actually f#$%ing the elements, becoming one with the elements, turning to gas. That’s why it’s better to burn out.”

Now, all can agree that the idea of going out in a blaze of glory doesn’t sound like a value-focused, fundamental-research driven investment manager. Rather, it invokes images of the “gun-slinging fund managers of the go-go sixties” or the aggressive-growth “TMT” managers of the late ‘90s. And in this decade, YOLO (you only live once) comes top of mind. Brazen speculators with “diamond hands,” “hanging on for dear life (HODL)” for “fear of missing out (FOMO).” Momentum managers are going so fast they’re “f#$%ing the elements, becoming one with the elements, turning to gas,” while value managers are seemingly rusting, fading away. They are seen to be “corroding, are letting the elements eat them,” in the words of Mr. Young and perhaps many an investment consultant, as well. This contemporary view was also the view during the previous mania – only dinosaurs still owned value stocks/old economy stocks/rustbelt stocks in 1999. The excitement of the internet or the image of a tractor rusting away in a field, what would you choose? Star Wars hyperspace or the malaise of the industrial heartland?

Merriam-Webster offers “archaic” and 157 other words as synonyms of rusty, none of them flattering. Time to toss Graham’s The Intelligent Investor into a rusty old trash bin.

“Out of the blue and into the black

They give you this, but you pay for that”

By now many of you are wondering why this missive is based upon a song that seemingly glorifies momentum investing. Three reasons come straight to mind. First, we are stewards of client money, hard-earned funds that we are pretty sure they don’t want to see burn out. We have a fiduciary duty to do our best to see that that doesn’t happen.

Second, as Mark Twain once said, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” The contemporary view of value investing just ain’t so. The advisability of buying things below their worth is an idea that has not gotten rusty, it is immortal. And third, while the thought of moving into the black may be daunting to musicians, it is the goal of those of us in the financial realm.

It is understandable that Mr. Young, like all of us, didn’t like the idea of fading into obscurity. And, when one is riding high, one wants the ride to last forever. It often feels like it will. But if one, Icarus-like, flies too close to the sun– burnout becomes likely. It’s a sad fact that in his suicide letter, Kurt Cobain wrote, “it’s better to burnout than fade away.” This understandably really shook Neil up and he refused to play the song anymore. Nirvana members later convinced him that Kurt would have wanted him to keep playing it. A lot of music fans wish that burnout wasn’t the final outcome for Kurt Cobain, nor for John Bonham, Jimi Hendrix, Whitney Houston, Michael Jackson, Janis Joplin, Keith Moon, Jim Morrison, Gram Parson, Elvis Presley, Prince, Bon Scott, Sid Vicious, Amy Winehouse, and so many others. The list of rappers alone is staggering. As with the arts, investments that figuratively move at the speed of light usually prove to be shooting stars. Portfolios that earn returns of 20% per annum, which fade over the years to 15% or 10%, end up having created significant worth in the future. Avoiding burnout should be the goal.

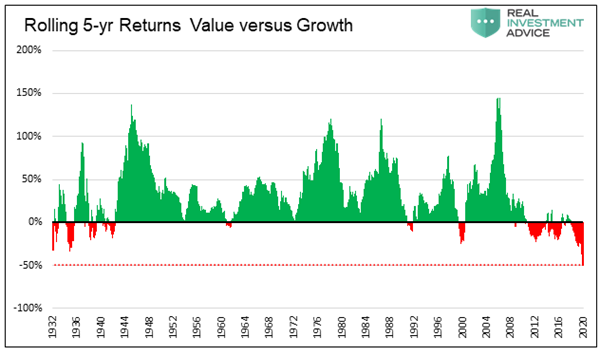

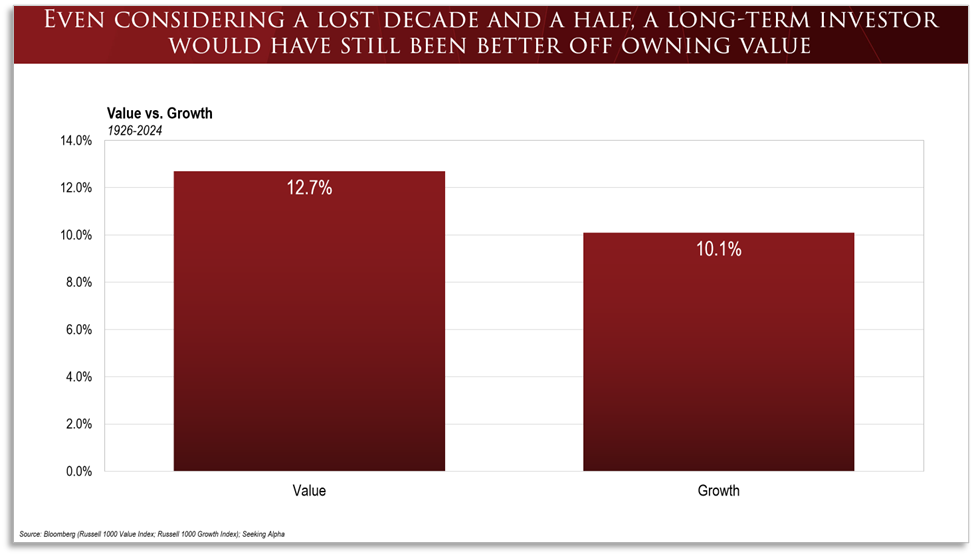

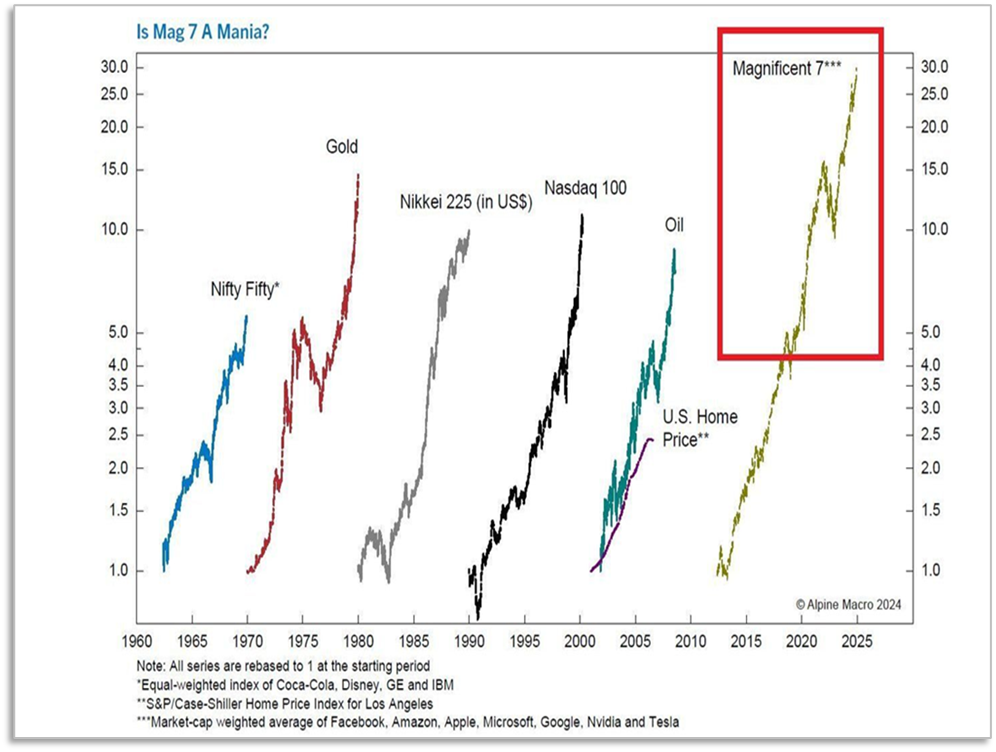

To back up these tenets, let’s look at the data. Just as the hot players in a casino always seem to be raking in the money, while in the end it is the house that inevitably wins, so it is in investing. The momentum investors rake in obscene amounts of money but usually give it back quickly. So it was, in the late 1920s, late ‘60s, late ‘90s, and we’ll have to wait to see if this time follows suit. The graphs below highlight some long-term history.

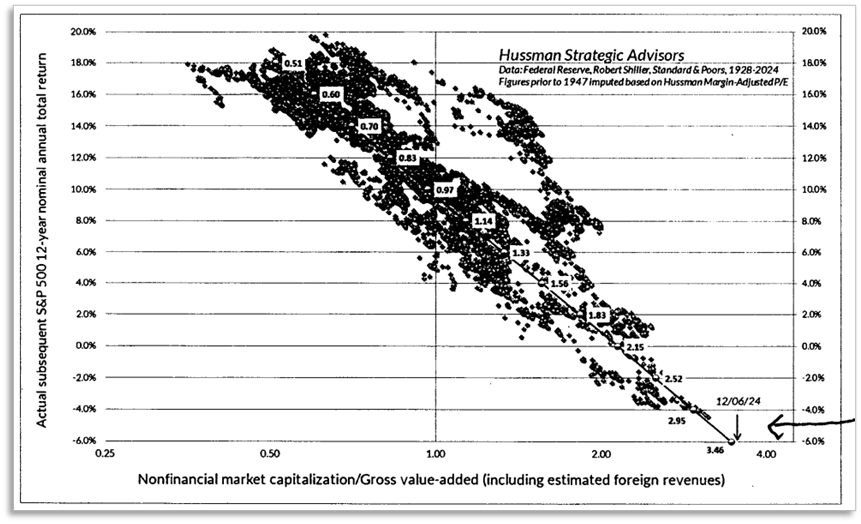

And the next chart evidences that historically, investment returns have been highly correlated to the starting point valuation – price mattered!

Okay, so history supports the logical conclusion that price matters, but isn’t it different this time? John Templeton said that “this time it’s different” are the most dangerous words in the English language. Let’s set aside my tremendous respect for him and explore the prospect that it might actually be different this time.

Artificial Intelligence is a game changer. We can’t even imagine what the world will look like in a decade; certainly the future will be rife with both abundant opportunity and “value traps galore.” Industries are changing and obsolescing. No argument here.

At the same time, we must caution that people may be underestimating the magnitude of change that resulted from the likes of telephone, canals, railroads, automobiles, airplanes, semiconductors, air conditioners, and yes – the internet. In addition to growth and a rising standard of living, all of these inventions also created the hazard of outmodedness for many companies/industries. Kopernik spends an inordinate amount of time striving to ascertain the disruptability of value stocks. Interestingly enough, during past episodes of rapid technological displacement, value stocks generally proved to be the best place to be when the excitement inevitably subsided. Equally important, most of the competitors vying to dominate these exciting areas of disruption turned out to be casualties themselves. The ultimate winners often saw their stock prices plunge materially before eventually rebounding to new heights.

While AI should not be underestimated, the “canal bubble” popped in the late 1700s, 1857 saw the first “railroad collapse,” followed by a second in 1873. The new technologies in 1929, 1968, and 1999 were world-changing. Yet all led to stock market collapses. The Devil Take the Hindmost, by Edward Chancellor is a great read with more on past manias. The chart below of five infamous examples of other times it was “different” shows that it may be a perilous road to go down, but let the journey begin.

The chart below of five infamous examples of other times it was “different” shows that it may be a perilous road to go down, but let the journey begin.

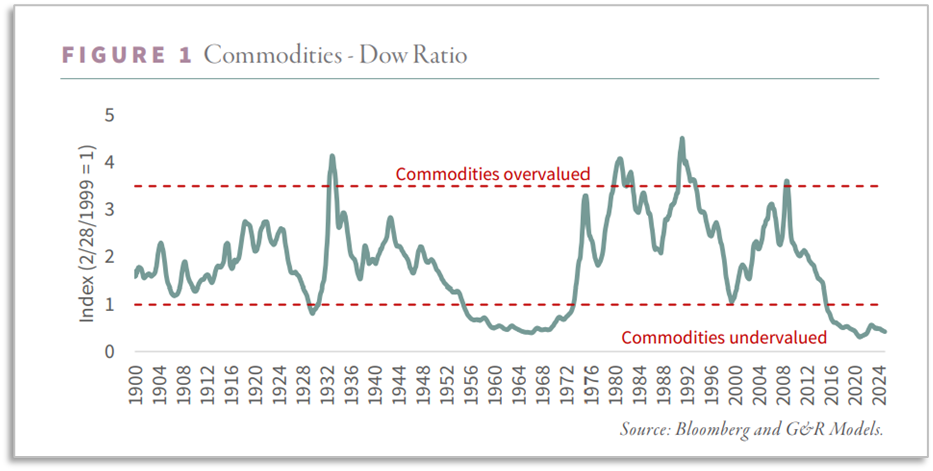

“And once you’re gone, you can never come back?”

Stepping back for a moment, an earlier chart showed that “value” has outperformed nicely over the past century, but buying assets that have outperformed over the long run didn’t work out so well for commodities in 1980, Japanese real estate and stocks in 1990, housing in 2007 (when people were saying that it had never fallen nationally), or value investors in 2007. Why should it matter now? We have a lot of sympathy for this view, living as we do in a cyclical world. Things overshoot, even good things, maybe especially good things. Our take on this is that people ought to pay attention to things that logically have good fundamentals and have demonstrated long-term superior performance while simultaneously turning a cautious eye toward excessive intermediate-term gains. For example, stocks have always proven to be a good long-term investment but needed to be avoided following outsized returns leading up to ’29, ’72, ’99, and ’07. Real estate has been a superior investment but was devastated in 1929 and again following the wildness of pre-2007. Speaking of 2007, the long-run and intermediate-run returns (8 years) of value, relative to growth, were extreme. It was time for growth to have its day in the sun. It was best to buy gold after it fell 70%, oil post a 70% drop, the NIKKEI subsequent to its 75% drop, and we’ll suggest, value post the massive underperformance of the past 17 years. Strong fundamentals and demonstrable long-term performance, in lockstep with outsized underperformance over the intermediate term, should be just what the doctor ordered. As for momentum stocks – Caveat Emptor.

Pivoting to another worthy argument against value, “if value requires market inefficiency, and the advent of AI, other technology, a plethora of data, and many hardworking CFAs are diligently arbitraging out any inefficiencies, isn’t value investing now past its prime?”

A pertinent question, and an excuse to segue back to our featured album – Rust Never Sleeps. It is said that Neil heard the name from Mark Mothersbaugh of Devo. They are an intriguing and innovative band that I was fortunate enough to see, at a small venue, back in the 1970s (and several more times in more recent decades). The first release of Hey Hey, My My was done by Neil Young and Devo together when they were filming Human Highway, a movie starring and co-directed by Mr. Young. It features a gritty, bizarre, 10-minute version of the song, with vocals by Booji Boy (pronounced boogie). The band chose their name, and their theme song Jocko Homo based on the idea that man was devolving rather than evolving. It’s a theme we’ve discussed in previous commentaries, though it has been a while. À la Mike Judge’s movie, Idiocracy, Jocko Homo explores the idea that the contemporary world may be dumbing us down.

Charlie Munger said that people calculate too much and think too little. It’s hard to disagree when many people now allow technology to do their calculating, and to tell them what music to listen to, movies to watch, places to eat, clothes to wear, candidates to vote for, and issues to get incensed about.

Baldo by Hector Cantú and Carlos Castellanos

And, when it comes to investing, most people now allow algorithms to choose which stocks to plough their hard-earned money into. That is how index funds work. Stocks are picked without any regard to fundamentals, news, valuations, or any other form of analysis. The bigger the weight in the index, the bigger the monetary commitment. The more expensive something becomes, the more exposure the “investor” now has to that holding. Passive investing effectively is momentum investing. Does this sound thoughtful? Does this sound rational? Hey hey, my my. Once again, let’s repeat a great quote from our friend Axel Krohne…

“It just does not seem right to me, that investing should be the only occupation in the world,

where without work, you should yield better results than the man who dedicates his life to it.

Secondly, investing while ignoring fundamentals of the businesses and allocating money just

based on popularity is totally opposite to my understanding of capitalism.”

Let’s not forget that rationality is one of the major assumptions underpinning the efficient market hypothesis. Computers, algorithms, AI, CFAs, MBAs, hard work, and access to data and information do not make people rational. In fact, it could be argued, with some empirical evidence, that over-reliance on technology and inundation of emotion-provoking information has made the mass of investors less rational.

Another twist is the idea that people are being rational to put their own needs ahead of those of the portfolio they are managing. Career risk is an important factor in the investment world. But whether sub-optimal portfolio decisions are irrational, or rationally immoral, the outcome is the same. For more on the subject of career risk, please look up Jeremy Grantham’s excellent thoughts on the subject. It’s another reason that the market is inefficient.

“It’s better to burn out than it is to rust”

It is arguable that passive methodologies, and other crowd-following strategies, are highly prone to both burnout and rust. The worst of both worlds: burnout due to inherent momentum qualities and rust, from inactivity. Things get rusty when they sit. Skills get rusty when they aren’t practiced or used. Charlie Munger was big on the latticework of mental models. He believed that just relying on data was a recipe for failure. And, in the investment world, intelligence, technology, and hard work are not the keys to success but merely the prerequisites to being in the investment business. Facts need to be understood in conjunction with other things, and it is important to understand heuristics, psychology, history, accounting, statistics, philosophy, and a host of other subjects to prosper in this business (he may have forgotten song lyrics 😉). When computers are parsing the data and making the decisions, the industry’s analytical skills might be prone to rust. Is this a step down the road to Idiocracy?

Speed bump by Dave Coverly

“Out of the blue and into the black

They give you this, but you pay for that”

This is the point at which this commentary turns upbeat. It’s too early to tell, but there is increasing evidence that we may have reached the point in the market cycle when active management/value investing becomes enjoyable and rewarding. The market gives you this and you only have to pay for that. Sometimes it will give you much more than you pay for. Taking advantage of these opportunities is Kopernik’s raison d’etre. Now is one of those times when diligent investors can get much more than they pay for. Why this is the case is a deep subject that is worth at least touching upon here. The more diligent the competition, the tougher active investment management becomes. The less interest people have in performing rigorous fundamental analysis, the easier it becomes. The universe of misanalysed securities enlarges. At this point in the cycle, analytical skills have become rusty, perhaps solid. Now seems the time to employ active management. The universe of mispriced stocks is enormous.

And, whereas going into the black means fading from the limelight in the music industry, it means making money in the business world. Now’s an opportune time for investors to scour this rust-infested world for hidden gems, those that are likely to move their portfolios solidly into the black.

Where might one look for rust-resistant bargains? A good place to start is with the antidote to rust – petroleum. (It worked for the Tin Man 😉.) The price of oil is half of what it was three years ago and its all-time high, back in 2008. That’s worth repeating, it’s less than half its price of 17 years ago, a time period during which gold rose by more than four times and the S&P 500 rose more than five times. Demand has not slowed. MEG Energy, Inc., a long-term holding, is currently being acquired but there are other attractively priced stocks, plus many good natural gas companies. Oil services stocks are now on our radar screen as well.

Movement works well as a rust preventer, and nothing moves the modern world like electricity. Nuclear and hydroelectric power are particularly interesting due to traits such as being virtually pollution-free, carbon-free, and low cost. They provide consistent baseload availability and possess barriers to competition. For those willing to venture into emerging markets, there are inviting bargains. Electricity generally comes from the aforementioned hydro and petroleum, and of course, from, once-again-popular, uranium. The price fell from $137/lb. several decades ago to the current price, circa $70/lb. We sold most of our holdings last year when prices were above $100 but have been taking advantage of the current opportunity to increase the position.

And what use is electricity without machines, cars, elevators, etc. to move and the technology, instruments, batteries, and data warehouses to power up? These things all require an abundance of semi-corrosion-resistant, rust-proof, base metals such as copper, nickel, aluminum, and many more. The following chart gives us a taste of the level of undervaluation:

Finally, perhaps the ultimate rust-proof assets are the mostly inert, precious metals. They have proven, over the long term, to be immune to the propensity of lesser forms of money to erode over time. Since the Federal Reserve was created in 1913, the rusty old U.S. dollar has seen 99.4% of its value erode away relative to gold (gold has moved from less than $20/oz to over $3300/oz). For those with interest, please note that holders of gold reserves (mining stocks) are a bargain relative to above-ground gold bullion, and, opportunistically, silver, platinum, and palladium are at unprecedented discounts to gold.

Before concluding, a few final thoughts may help tie things together. The song and album address mankind’s fear of losing the limelight. Mr. Soul, a song from Neil Young’s Buffalo Springfield days, wrestles with the temptation, and simultaneously with the undesirability, of letting the crowds affect your thoughts and actions. Value investing is always tough, and the past 17 years of lagging momentum stocks have been historically painful. It’s been said that there’s nothing worse than watching your friends get fabulously wealthy while you’re missing out; there’s nothing worse than having rusty relative performance while others are going so “fast you’re actually f#$%ing the elements, becoming one with the elements, turning to gas.” As mentioned earlier, the markets are not inefficient because people are dumb or lazy or clueless. They are inefficient because people are irrational. They are fearful of missing out on the excitement, the riches. They understandably, yet regretfully, focus more on risks to their career than risks to the portfolios. They shy away from unpopularity (fading away) and run from pain. The longer something is out of favor, the greater the pain. The greater the pain, the greater the degree of undervaluation. That is why value investing has had such superior performance over the decades and why it has performed best following periods of underperformance. The fourth quarter of 2024 may prove to have been the point of maximum pain for value investors. Time will tell.

“It is difficult to get a man to understand something

when his salary depends upon his not understanding it.”

– Upton Sinclair

Conclusion

As to whether to burn out or fade away, we would suggest – neither. Attractively valued stocks seldom flame out the way momentum stocks habitually do at the end of every mania, nor do they fade away as fiat currencies always have. Whereas the down times for momentum tend to be disastrous, the longest, deepest, darkest out-of-favor period for “value” stocks and international stocks alike, 2007 – 2024, led to decently positive returns for the MSCI ACWI Value Index, which generated annual returns of over 5% (139% cumulative gain over the same period). Whereas value stocks infamously contain many rust-prone companies, value portfolios stay active. They don’t rust. Meanwhile, passive strategies risk paying the price for inactivity and other momentum stocks risk the eroding effects of desuetude.

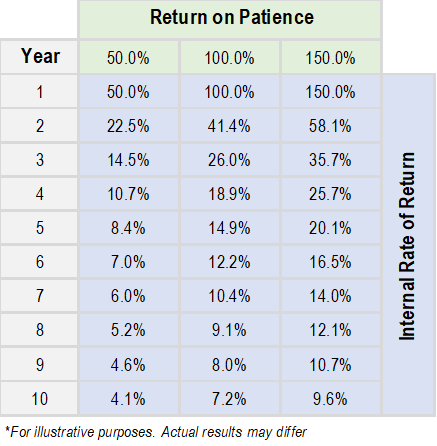

“Value” stocks more than held their own during the past, desolate decade-and-a-half, and there are many reasons to be optimistic about the next decade. “Value” stocks are very attractively valued, many offer protection against the rusting away of the U.S. dollar (and other fiat currencies), they tend to own scarce goods that are desired by the world’s 8-billion people and are generally resistant to obsolescence. And, whereas inaction leads to rust, patience does not. The prospective “return on patience” is currently enticing.

“The stock market is a device for transferring money from the impatient to the patient.”

– Warren Buffett

Compare the return possibilities suggested by the table above to the 4.5% on offer for 10-year treasury bonds, or to the negative returns that current valuations portend for the popular U.S. indices, based upon the Hussman Strategic Advisors chart shown earlier. The choice should be easy in this very bifurcated marketplace. Our portfolios currently trade below book value, just above one-times sales, and an earned yield of around 7%. It’s time to head Out of the Blue and Into the Black!

Like rock and roll, value investing is here to stay.

Rock and Value can never die

There’s more to the picture

Than meets the eye.

Hey hey, my my.

Cheers,

David B. Iben, CFA

Co-Chief Investment Officer & Portfolio Manager

May 2025

Important Information and Disclosures

The information presented herein is proprietary to Kopernik Global Investors, LLC. This material is not to be reproduced in whole or in part or used for any purpose except as authorized by Kopernik Global Investors, LLC. This material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate.

This letter may contain forward-looking statements. Use of words such was “believe”, “intend”, “expect”, anticipate”, “project”, “estimate”, “predict”, “is confident”, “has confidence” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are not historical facts and are based on current observations, beliefs, assumptions, expectations, estimates, and projections. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. As a result, actual results could differ materially from those expressed, implied or forecasted in the forward-looking statements.

Please consider all risks carefully before investing. Investments discussed are subject to certain risks such as market, investment style, interest rate, deflation, and illiquidity risk. Investments in small and mid-capitalization companies also involve greater risk and portfolio price volatility than investments in larger capitalization stocks. Investing in non-U.S. markets, including emerging and frontier markets, involves certain additional risks, including potential currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, less liquidity, less disclosure, and the potential for market volatility, expropriation, confiscatory taxation, and social, economic and political instability. Investments in energy and natural resources companies are especially affected by developments in the commodities markets, the supply of and demand for specific resources, raw materials, products and services, the price of oil and gas, exploration and production spending, government regulation, economic conditions, international political developments, energy conservation efforts and the success of exploration projects.

Investing involves risk, including possible loss of principal. There can be no assurance that a strategy will achieve its stated objectives. Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus. Investments in foreign securities may underperform and may be more volatile than comparable U.S. securities because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. Investments in foreign and emerging markets present additional risks, such as increased volatility and lower trading volume.

The holdings and topics discussed in this piece should not be considered recommendations to purchase or sell a particular security. It should not be assumed that securities bought or sold in the future will be profitable or will equal the performance of the securities in this portfolio. Kopernik and its clients as well as its related persons may (but do not necessarily) have financial interests in securities, issuers, or assets that are discussed. Current and future portfolio holdings are subject to risk.

Commodities may be affected by changes in overall market movements, changes in interest rates, and other factors such as weather, disease, embargoes, or political and regulatory developments, such as trading activity of speculators and arbitrageurs in the commodities. Investing in commodities entails significant risk and is not appropriate for all investors.