London Calling (Nov 2025)

As many of you know, Kopernik has a Global Immersion program, the ninth iteration of which was this past summer. A significant percentage of Kopernik’s investment team journey abroad every summer in search of stock market bargains in countries that we believe are rich in culture and history but are misperceived and undervalued.

“So much left to know, and I’m on the road to find out”

– Cat Stevens, “On the Road to Find Out”

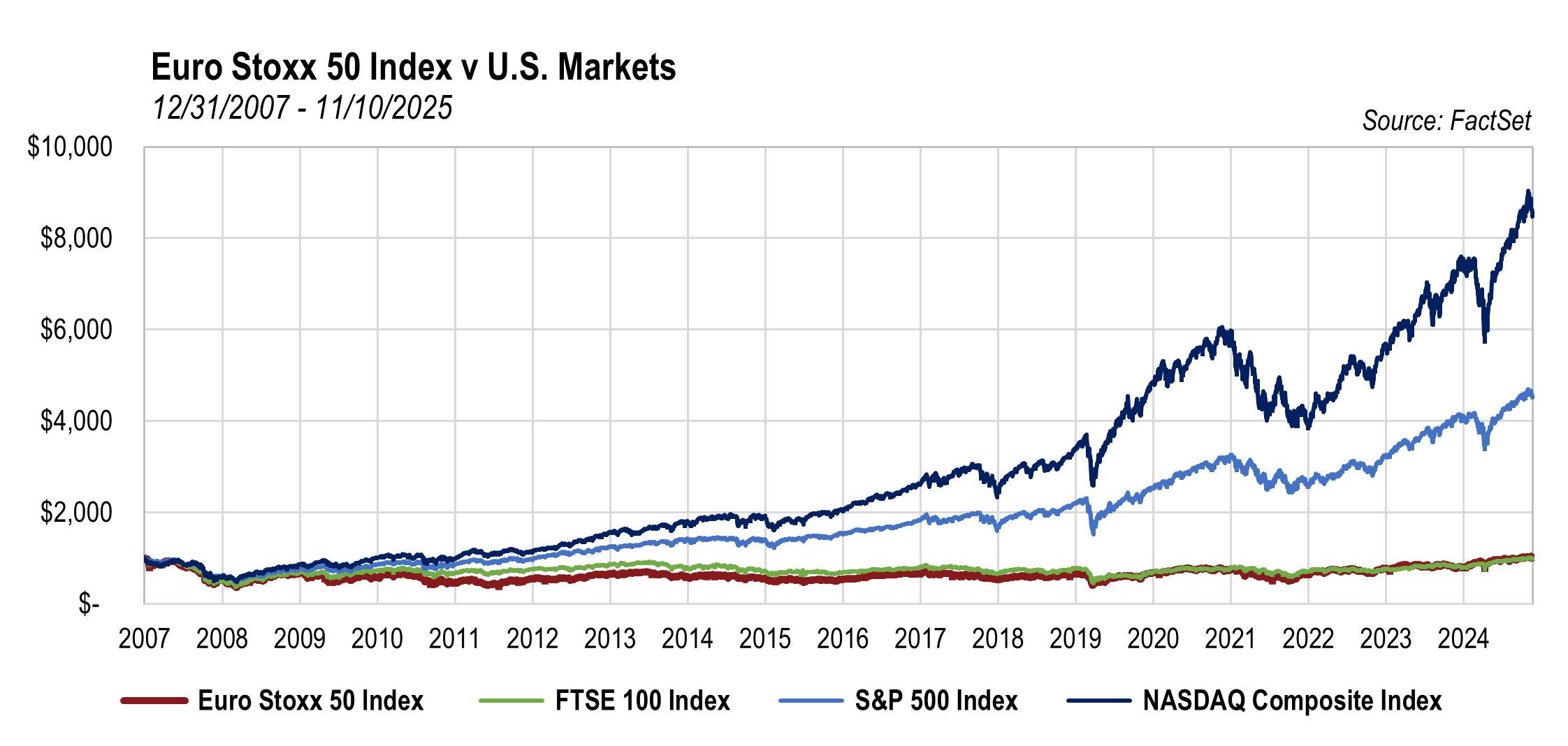

We are so fortunate to be a part of this industry, a field where we are always learning and meeting interesting companies and people. And the more we learn, the further stoked our intellectual curiosity becomes. This year we searched far and wide and found London calling. Many stocks are significantly undervalued in the UK as are many nearby on the Continent. The number of UK stocks in the portfolio grew over the past year and don’t be surprised if it continues to. Why? This chart shows the underperformance (relative to U.S. markets) over a long period of time, 26 months short of two full decades.

The price of the UK index is actually down over the past 18 years (almost), but the total return, inclusive of dividends, is up 96%. This amounts to a paltry 3.8% annually. The European index (STOXX 50) is up a similar 3.9% per year. By comparison, the S&P 500 and NASDAQ indices have compounded at 11% and 14% per year, respectively. As a result, as illustrated in the following chart, the entire UK market amounts to just over 5% of the size of the market cap of its former colony, the United States.

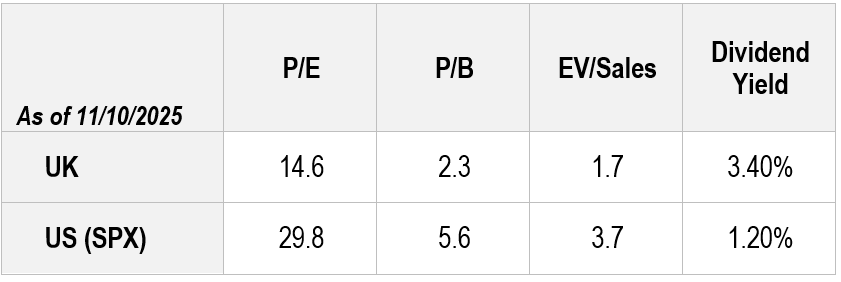

Most importantly, in terms of valuation, the UK market is reasonably attractive on most metrics; the U.S. – not so much:

“But then a lot of nice things turn bad out there

Oh, baby, baby, it’s a wild world

It’s hard to get by just upon a smile”

-Cat Stevens, “Wild World”

Owners of highly valued but wonderful stocks should keep in mind Stevens’s truism that, on occasion, a lot of nice things turn bad out there. More on that later, as well as on the more fortuitous fact that those looking off-piste will find that sometimes high-quality companies trade at values well below their true worth, and much below the index averages shown above.

Putting the stock market aside for a moment, these commentaries often are inspired by history and/or music. Regarding both, London is rich. The phrase “London Calling” is derived from the opening of the BBC World Service broadcasts, particularly during World War II, where the station identified itself with the line “This is London Calling.” The Clash, one of the best-known and most successful British punk bands, used this as the title song of their highly successful album.

I was, of course, unable to see the Clash, who disbanded decades ago. Often in search of good music, I did try, unsuccessfully, to get tickets to the famous Glastonbury Music Festival. I met various locals who, over many years, have never succeeded in grabbing the scarce tickets. They’ve succeeded at making scalping difficult. Fortunately, there was ample opportunity to see good concerts and theatre. Hence – this commentary isn’t centered around the Clash, but upon a hodge-podge of songs from artists who I had the privilege to see perform live over the summer. In this fast-tempo, disharmonious, and off-beat world in which we find ourselves, a disjointed medley seems a more than appropriate way to capture the zeitgeist. The summer captured the whole spectrum from the ambient classical music of Ludovico Einaudi at the Royal Albert Hall to that of garage rock revival band The Fuzztones, at Club 100. It included Pulp, at O2, Guns N Roses, at Wembley, and Neil Young, Cat Stevens, Van Morrison, and Stevie Wonder at Hyde Park. And, both exciting and terrifying, there was the concert performed by holograms – ABBA Voyages, Abba-tars they called them. More on that later.

Rolling Stone magazine named London Calling the best album of the 1980s. While it was released in 1979 in the UK, it was 1980 before it was released in the US. The BBC World Service’s station identification: “This is London calling …” was used during World War II, often in broadcasts to occupied countries. The song is about the apocalypse. But fear not, we are not headed in that direction. The ice age, famines, food shortages, floods, wars, and nuclear “errors” that dominated the news in the late ‘70s, to which the Clash are referring, never came to pass. Oh, and by the way, “ice age” is not a typo. I remember well that global freezing, not global warming, was a fear at the time. The general mood of society in the late ‘70s, an angst well captured by the Clash and many other punk bands of the time, is reflective of a lot of tough times, including a decade of inflation, a 4-decade long bear market in bonds, and a bear market in stocks that was approaching a decade-and-a-half. Contemporary society, 43 years into a stock bull market and having only recently said farewell to a 4-decade long bond bull market is in no way equipped to comprehend those times, much less empathize.

Back then financial assets were very attractive and fiscal and monetary policies had recently swung from profligate toward reasonable, all of which is in sharp contrast to the contemporary world. This missive hopes to balance the negativity with ample positivity. The world is changing rapidly, which creates great challenges and tremendous opportunities. Herein we explore some changes, search for ways to minimize the inescapable risks and to capture strong, positive asymmetries offered on well-placed securities. As is our MO, we’ll start with the dour and move our way toward the exciting opportunities.

“Precious time is slipping away

But you’re only king for a day

It doesn’t matter to which God you pray

Precious time is slipping away”

-Van Morrison, “Precious Time”

Moving on from the Clash, British Summer Time concerts at Hyde Park proved to be a wonderful way to enjoy music. The festival featured, back-to-back, Van Morrison, Cat Stevens, and Neil Young on one fine Saturday evening. It really was a great time and interesting timing, given that Neil Young’s Rust Never Sleeps was the inspiration for my most recent commentary. It had been many years since I last saw Van Morrison in concert, and I was pleased that he was much better this time. Some people age well. It was disappointing that he didn’t play “Precious Time,” one of my favorites, but that need not hamper its inclusion here. There are so many messages within.

Fifteen years ago, “value” investors were sitting on top of the world. As they say, “it is good to be king.” But, as Van reminds us in the lyrics above, the world is a cyclical place; nothing is permanent. We investors who focused on the fairness of pricing knew in our hearts that returns as strong as those of the aught decade were too good to last, uninterrupted through eternity. But few could have imagined the depth and duration of the underperformance that lay ahead for the ensuing decade and a half. How quickly euphoria can give way to pain. Passive and other forms of momentum “investing” now wear the crown. Are these investors aware that “it doesn’t matter to which (investment style) they pray,” precious time is ticking away in their realm? More importantly, do their investors know? Who knows, the scepter may have already passed. Time will tell. As they say in England – The King is dead, long live the King.

Similarly, the Magnificent Seven currently look quite royal, adorned with the crown. And this group of companies do seem better than their brethren from previous eras. They are undeniably regal, bejeweled with mostly wide economic moats, high levels of profitability, strong ties with government, and massive economies of scale. They may prove to be worthy of their current, stratospheric valuations, but kingdoms are often fleeting. Most of the high-flying technology companies from when I was a young tech analyst in the ‘80s are no longer with us. Most of the younger readers probably won’t recognize many of the names. Computervision, Intergraph, Digital Equipment, Apollo Computer, Coleco, and Lotus probably don’t ring a bell for many.

More recently, the success of Apple, Microsoft, Nvidia, and a handful of others may lead to “recency bias,” helping us forget that the vast majority of the darlings of 1999’s TMT mania are now nothing more than testaments to the folly of mankind. Now, not to leave readers with the wrong impression, we are not tech haters. The tech titans should hold their value over the very long term. People correctly point out that these companies are in a completely different league than most of ‘99’s high-fliers. And as to the power and sustainability of many of these juggernauts, we’ll allude to that in several pages. Since 1999 isn’t the best comparison for today’s heroes, perhaps canals of the mid-nineteenth century works better. They were game changing, value-added, and sustainable – still with us today. Ditto, the railroads of the late 1800s. The tech companies of the late 1920s and 1960s were world changers. Telephone, telegraph, assembly lines, automobiles, semiconductors, global brand compounders, etc. We are all better off for their existence but very few of these transformative companies are still with us. Fewer still were decent investments during the decade following their coronation. All of these periods of exceptional invention were accompanied by a major market mania and subsequent bust. Amazon could be bought for 90% less in 2002 than at the peak of several years earlier. We’ll leave the timing of bubbles to the more daring and nimble. Later, we’ll get to areas that we believe are lucrative yet much safer.

“The history book on the shelf

Is always repeating itself”

-ABBA, “Waterloo”

These lyrics from Waterloo simultaneously serve as a further reminder of tech cycles and as a segue to some thoughts about the impact of tech in the future. ABBA is a bit popish for my taste, yet I confess to really liking a lot of their music. The subject at hand, though, is not ABBA but ABBA Voyages. Per Wikipedia, ABBA Voyage is a virtual concert residency by the Swedish pop group ABBA, taking place at the ABBA Arena in London from May 27, 2022, to January 4, 2026. The concerts feature digital avatars of the band, known as “ABBAtars,” performing alongside a live band, using original vocals recorded by the group.

This experience was simultaneously exciting and terrifying. These “holograms” look very real. They aren’t fuzzy, they move quickly, they hold hands and dance, they appear to play instruments. More importantly, they were able to fire up the crowd. It was kind of chilling to see people laughing, crying, cheering, and dancing in response to computer generated images. What is one to make of this?

Conventional wisdom holds that AI, computers, and technology will make the world more efficient, grow faster, and be more productive. This could prove to be accurate. Looking at the avatars, it seems that concerts can be held without having to pay, organize, and transport people. The same could be true for movies, TV, and sports – who needs people anymore? Imagine the cost savings and the reduced hassle factor. And the same can be true for white collar jobs; tech has already replaced many. Heck, most securities analysts have already been replaced by algorithms that passively assemble portfolios. Lawyers, I’m told, are seriously at risk. The medical industry is rapidly becoming digitized. Imagine the savings to society and the economy from so many labor costs being assumed by computers.

And yet, it is always advisable to ponder both sides of a situation. It is said that Henry Ford believed that if you pay your people more, they could buy more of your products. If tech takes all of our jobs, who will be paying for concerts, sporting events, movies? Who will even need legal services, much less pay for them? And what of the quality? A computer can play chess better, but can it entertain a crowd? (Admittedly, as mentioned above, it clearly can on some level and people have sent me some pretty good AI-generated cover songs.) But, importantly, sometimes musicians that are so-so talent wise can really connect with a crowd. It is knowing the ability of an athlete to make an almost superhuman move one moment and a silly blunder the next that makes sporting events so exciting. Conversely, we receive many letters from job applicants that are so beautifully written and accurate, and at the same time are soulless, clearly written by AI. As lifelike as the ABBA-tars seemed, something was missing. They lacked soul.

I, for one, believe that there will still be an important role for human beings long into the future. I feel strongly that active investment analysts being replaced by mindless algorithms that buy stocks based entirely upon their residence within an index, is not a secular trend but evidence of a cyclical phenomenon that has reached manic proportions. Caveat Emptor! Rather than replacing humans, the algorithms – by creating and magnifying market inefficiencies – are likely sowing the seeds for massive outperformance by active managers in the future.

Thomas Jefferson, Alexander Hamilton, and James Madison making deals in the room where it happens while Aaron Burr criticizes the backroom dealings.

“The Room Where It Happens,” Aaron Burr & Ensemble, Hamilton.

As we transition from the uncertainty that technology brings to the future to what that means to investors (and how they should cope), let’s also segue from concerts to theatre and what an increasingly unbalanced political environment may mean to investors (and how to cope). It had been a while since I’d last seen Hamilton, so I decided to see it again, in London. It was strange seeing a play about Revolutionary times while sitting in England. I didn’t know that much about King George III, but apparently he’s fair game for ridicule in the UK as well. The soundtrack mostly isn’t my kind of music but The Room Where It Happens is a catchy and thought-provoking song and serves well as an intro for our next topic.

“No one else was in

The room where it happened

The room where it happened

The room where it happened

No one really knows how the game is played

The art of the trade

How the sausage gets made

We just assume that it happens

But no one else is in

The room where it happens”

-Aaron Burr, “The Room Where It Happens”

(music and lyrics by Lin-Manuel Miranda)

One of the questions we get asked is, effectively, how can you guys compete with the big, powerful competitors who often find themselves in the room where it happens? It is pointed out that many congressmen are generating returns far, far in excess of the S&P 500, by trading on inside information. It is, apparently, not illegal for them. They are even allowed to invest in a stock just prior to announcing that their committee is steering beaucoup bucks toward said company. Arguably, they almost make the bucket shops of a century ago seem reputable.

Apparently, others have access to inside information, too. The newspapers, in 2009, illuminated the fact that top members of the Treasury and the Fed met with hedge fund managers to discuss which financial institutions would get preferential treatment. In 2020, trillions of dollars were conjured up and doled out mostly to the chosen. It is well known and documented that the room where many decisions are currently made resides in Mar-A-Lago, where many exemptions are granted to tariffs and the like. How, we are asked, can we compete in this business when we are never in the room where it happens?

Let’s start out with the admission that it is true – we are never in that important room. People may or may not appreciate the fact that I am “old school” enough to actually be proud of the fact that Kopernik doesn’t trade on inside information. I’m confident that this is true for all my colleagues at Kopernik as well. Secondly, as the narrative above points out, the deck has been stacked for decades, and yet value investing has yielded superior returns in almost every decade, except, of course, the recent decade and a half. Going further back, the lyrics quoted above from Hamilton, which reference the Compromise of 1790, show that backroom deals have been going on for centuries. So, let’s not allow recency bias to cause us to conclude that contemporary news will have an outsized impact on the ability of boutique active managers to significantly outperform in the future. (As a quick editorial note, it does make one nostalgic for the days when political adversaries could compromise.)

But, to more directly answer the question of competitiveness – depending on the specifics, in many cases we cannot compete. Fortunately, in other cases, we arguably can more than compete. We have important competitive advantages. Let’s delve further.

Three decades ago, I wrestled with the issue of how my small firm could compete with large firms with hundreds of analysts and offices around the globe. After a period of pondering, analyzing, and soul-searching, I concluded that while my firm was unfortunately at a competitive disadvantage when it came to access to information, fortunately, this obstacle paled in importance to the three competitive advantages we did have: organizational, analytical, and behavioral. The answer is the same now regarding our current lack of access to the powers that be and their knowledge. We wouldn’t trade positions with anyone. We vastly prefer our competitive advantages.

So, what are the possible implications of the current situation? If Kopernik were to enter the Venture Capitalist market, you probably shouldn’t invest with us. We don’t have access to the best idea nor the ability to crown the eventual winner by blitz-scaling, pooled resources, etc. If we were to venture into short-term trading strategies, you’d be well advised not to follow us there either.

However, following years of massive flows into passive funds which are price-agnostic, momentum-focused, and stacked toward mega-cap stocks, we believe that important competitive advantages reside with active managers, especially those with the size, aptitude, integrity, and disposition to find and capitalize on the incredible opportunities being overlooked and/or shunned by the indexers and other mainstream investors. Having confessed to an informational disadvantage, we believe that our competitive advantages in terms of organization, analysis, and behavioral mindset will prove to be much more valuable. Time will tell.

An advantage accrues to those who can exploit an odd behavioral characteristic of the marketplace – its binary thought process. Often industries/countries/securities are labeled as good or bad, nothing in between. Life is seldom that simple. Famously, people are known to think less rationally as part of a crowd, with groupthink being particularly strong during cyclical extremes. During the extreme saturation of U.S. exceptionalism, many other categories have been derisively cast aside. Hence a plethora of opportunities.

For example, natural resources continue to trade below 2007 prices in many instances. They were considered “must own” during China’s boomtimes, circa 2007. Yet, they are frowned upon today even though China’s economy has grown much bigger than anticipated and the earth’s resources have become much more scarce and more difficult to find and extract. We believe that the best deals require the ability to buy small/mid-sized securities, the willingness/knowhow to invest where the assets reside, and the analysis of intrinsic value versus guesstimates of future timing.

Elsewhere, emerging markets are considered to be a category of investment rather than a label spuriously given to a very diverse group of countries, in which reside the vast majority of the world’s people, land, resources, and growth potential. Many good companies are still on sale, even post this year’s minor return to favor. Here again, it is our opinion that the best deals require the ability to buy small/mid-sized securities and the willingness/knowhow to invest where the assets reside. As to Frontier markets, everything just said about EM applies, but in spades. We could add a lot here about our competitive advantages and how and why we utilize them. But to keep this reasonably short, we’ll merely refer you to our website or suggest you call us. The only point that we wish to make here is that we believe that they make prospects for wonderful return/risk asymmetries available to us.

Increasingly, other industries and specific stocks are finding themselves on the outs, creating attractive entry points. We continue to find that volatility creates opportunities, not risk. Lastly, while cash is a lousy long-term investment, it serves well as a residual of a well-disciplined process, providing optionality/ability to take advantage of volatility. For more on that, please refer to previous commentaries or our Q3 2025 quarterly call. Similarly, we could list a lot of examples of the bargains we are finding here, but instead refer you to our website or look forward to talking with you about them and/or cash.

In conclusion, the world is changing and doing so at an accelerating rate. Many of the changes are concerning and the deck is increasingly stacked in favor of the large, the connected, and possibly to the non-humans (AI and other technologies). Perplexingly, the financial markets are trading at/near all-time high valuations even as risks march steadily higher. Fortunately, computers and mega-investors are seemingly unable to invest in many areas and have left behind ample money-making opportunities for those who have not delegated their decision making to computers nor to convention. Many countries, emerging markets, frontier markets, properties, and scarce/needed resources are trading at their levels of decades ago. This seems a particularly poor time to give up on the lowly valuations accorded promising assets. It is said that the meek shall inherit the earth. 😊

We, at Kopernik, continue to take advantage of these opportunities and to never abrogate our responsibilities by handing them off to algos, nor by succumbing to a misguided, cyclically influenced, philosophy/mindset du jour. We are continually grateful for your partnership and support. We wish you a healthy and happy holiday season.

Cheers,

David B. Iben, CFA

Co-Chief Investment Officer & Lead Portfolio Manager

November 2025

Important Information and Disclosures

The information presented herein is proprietary to Kopernik Global Investors, LLC. This material is not to be reproduced in whole or in part or used for any purpose except as authorized by Kopernik Global Investors, LLC. This material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate.

This letter may contain forward-looking statements. Use of words such was “believe”, “intend”, “expect”, anticipate”, “project”, “estimate”, “predict”, “is confident”, “has confidence” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are not historical facts and are based on current observations, beliefs, assumptions, expectations, estimates, and projections. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. As a result, actual results could differ materially from those expressed, implied or forecasted in the forward-looking statements.

Please consider all risks carefully before investing. Investments discussed are subject to certain risks such as market, investment style, interest rate, deflation, and illiquidity risk. Investments in small and mid-capitalization companies also involve greater risk and portfolio price volatility than investments in larger capitalization stocks. Investing in non-U.S. markets, including emerging and frontier markets, involves certain additional risks, including potential currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, less liquidity, less disclosure, and the potential for market volatility, expropriation, confiscatory taxation, and social, economic and political instability. Investments in energy and natural resources companies are especially affected by developments in the commodities markets, the supply of and demand for specific resources, raw materials, products and services, the price of oil and gas, exploration and production spending, government regulation, economic conditions, international political developments, energy conservation efforts and the success of exploration projects.

Investing involves risk, including possible loss of principal. There can be no assurance that a strategy will achieve its stated objectives. Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus. Investments in foreign securities may underperform and may be more volatile than comparable U.S. securities because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. Investments in foreign and emerging markets present additional risks, such as increased volatility and lower trading volume.

The holdings and topics discussed in this piece should not be considered recommendations to purchase or sell a particular security. It should not be assumed that securities bought or sold in the future will be profitable or will equal the performance of the securities in this portfolio. Kopernik and its clients as well as its related persons may (but do not necessarily) have financial interests in securities, issuers, or assets that are discussed. Current and future portfolio holdings are subject to risk.

Commodities may be affected by changes in overall market movements, changes in interest rates, and other factors such as weather, disease, embargoes, or political and regulatory developments, such as trading activity of speculators and arbitrageurs in the commodities. Investing in commodities entails significant risk and is not appropriate for all investors.